Enterprise and Consumer Problems to Solve

In my opinion, the best-performing stocks over the long term are companies that identify and solve complex problems that impact the enterprise and consumer markets. The best companies of all do this and choose to solve problems that impact how we live on a daily basis. Examples of this are shown through the FANG stocks and others like Nvidia, Zoom, and Teladoc. I believe Schrödinger fits the bill when it comes to solving complex problems that impact how we live on a daily basis and impact both enterprise and consumer markets. I believe Schrödinger’s mission statement says it all, “To improve human health and quality of life by transforming the way therapeutics and materials are discovered. “The enterprise market has benefitted from lower costs and faster times to the discovery of drugs and new materials. The consumer market has already benefitted from two new oncology drugs already being FDA approved and several phases I and phase II trials beginning for other drugs.

Leadership & Company Culture

Typically, founder-led companies outperform other companies in the stock market, especially if the company has a lot of insider ownership in the stock because everyone has “skin in the game”. Other companies with founders who stay involved regardless if they are the CEO or have a lot of stock also outperform the market. This is because the founders can provide guidance to leadership and ensure their creation stays successful and continues to surpass what they envisioned. This has been the case for Schrödinger as President and CEO Ramy Farid, Ph.D. has been committed to working for Schrödinger for the last 19 years. The company’s co-founders Richard Friesner and Bill Goddard are still involved and on the board of directors to provide additional guidance.

Schrödinger was founded in 1990 by Richard and Bill and their involvement with the company has continued 31 years later. The long term commitment from Richard, Bill, and Ramy illustrate it was not just about taking the company IPO this past February of 2020, but something much greater. Ramy commented on this in an interview recently on the podcast The Moneyball Medicine, “that there is something greater they are trying to achieve with discovering new drugs & materials that have never existed before”. This is also reflected in the company culture and this culture has received third-party recognition by several critics. Schrödinger has a 4.6 out of 5-star rating on Glassdoor for being a great place to work at. Ramy has a 96% rating on Glassdoor as CEO and the company has a 91% recommendation to a friend rating for being a great place to work at. Schrödinger made the 2019 and 2020 Crain’s Best Place to Work at in NYC List and made the Top 10 out of Best 100 Companies to work at on BuiltinNYC.com.

I believe these results stem from founder-led involvement and a great leadership team but also a company culture with core values that all employees have embraced. According to Schrödinger’s website their company culture values, integrity empowers collaboration, and champions the spirit of discovery. These core values spell the word STRIVE, the S is for science, T is for teamwork, R is for respect, I is for innovation, V is for veracity, and E is for empowering. The below image from their website provides insight on each core value and the third-party high reviews show this culture is being embraced. I believe a longstanding well-developed company culture that is owned by employees and modeled by leaders can be a competitive MOAT in any industry.

Financial Model that Provides Sustainability & Innovation

For a company to continue to grow & beat their competition they have to also have a financial model that makes it easier to retain customers, lower the cost of obtaining new customers through net revenue expansion & continue to innovate. Schrödinger’s financial model provides all of this. Their physics-based computational platform enables collaborators to discover high-quality molecules faster, at lower costs, and with better accuracy than traditional trial by error methods of drug discovery. What may take a company five or six years to get a drug discovered & ready for clinical trials sometimes may take only two or three years & have an optimal property profile for the trial.

Not only does Schrödinger have the patents to protect their software drug discovery platform but by design, their SaaS model makes it lower cost to acquire new customers. This SaaS platform for drug discovery helps lower costs for them to acquire new customers because their current customers are purchasing more as time goes on & Schrödinger is gaining other revenue streams through their own internal drug discovery programs & collaborative partnerships.

Business Model that Breeds Revenue, Partnership, and Customer Optionality

Schrödinger is transforming how both therapeutics and materials are being discovered, giving the company multiple avenues to grow. Legendary hedge fund manager David E Shaw realized this and invested in Schrödinger in 2001 and continues to have a big stake in the company with nearly 14% share ownership. The other billionaire invested in Schrödinger is Bill Gates, with the Bill & Melinda Gates Foundation owning over 23% of shares. The lack of shares that Co-Founder Richard Friesner owns at only 2% does not bother me like it normally would because he is still on the board of directors along with co-founder Bill Goddard. In addition, having investors like David E Shaw, Bill Gates, and Institutions such as The Vanguard Group & BlackRock, Inc, and Ark Investment Management believing in this company, has me more confident & excited than ever!

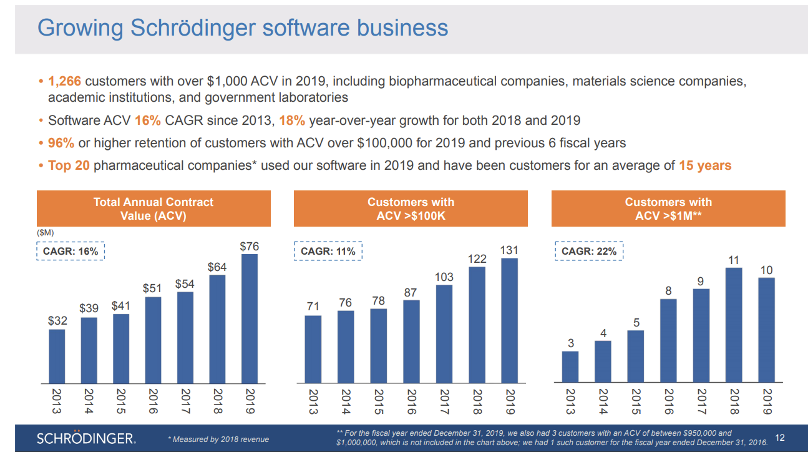

By creating this patented physics-based computational platform Schrödinger is able to make reoccurring revenue with their SaaS business with the platform in which they have over 1,250 customers worldwide & growing. The software business has a gross margin of 80% & 37% y/y revenue growth in the first nine months of 2020. The other part of the business growing even faster is the drug discovery revenue which resulted in a 96% CAGR from 2017-2019.

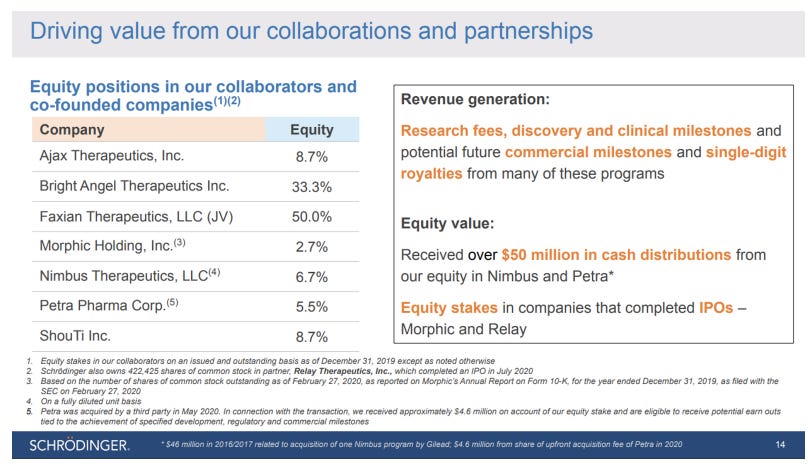

In 2020 the in-house drug pipeline attracted Bristol Myers Squibb to strike up a $2.7B deal with Schrödinger, which included $55M in cash upfront and the rest in milestone payments linked to success over different stages of drug development. Schrödinger has also structured deals previously with other big names like AstraZeneca, Sanofi, and Bayer. This illustrates that the platform Schrödinger has built for drug discovery is industry-leading and other companies are willing to pay to use it but also pay for partnerships in collaboration with the internal drug discoveries Schrödinger has made on its’ own. Schrödinger already has over 10 different company collaborations going on right now globally and some are in IND enabling phases, phase 1, or even phase 2 clinical trials. Schrödinger also has gained equity positions in their collaborators and other co-founded companies such as Relay Therapeutics. This is just another revenue stream that will continue to expand for Schrödinger in the future.

The other revenue stream of business that no one has talked enough about is the discovery of new materials for multiple industries. The molecule simulation platform that Schrödinger has can be utilized for new materials in other industries such as energy with batteries, fuel cells, and hydrogen storage materials, organic electronics, and polymers, and soft matter. The Schrödinger platform is the foundation of design for novel materials in several industries such as aerospace, energy, semiconductors, and electronics.

Imagine if Schrödinger were to strike up deals with EV companies or other disruptive technology companies that require new molecule discovery. With Schrödinger having $630 million in cash and $0 debt, they have the flexibility to get creative and spend money on R&D for application in other industries to develop potential new revenue streams. Besides the excellent leadership, company culture, financial sustainability, and first-mover competitive advantage that Schrödinger has, my favorite thing about Schrödinger is their synergistic business model and vision they adhere to. Schrödinger is focused on continuing to improve their software solutions & platform, which in turn yields better results for their commercial customers, which will attract new customers, which fund their new internal drug discovery pipeline.

I like investing in companies that solve complex impactful problems that impact both the enterprise and consumer markets. Schrödinger does this brilliantly and has reached the product or market fit mode & is ready to exponentially grow in the long term. This final slide from Schrödinger’s investor relations overview presentation illustrates their bright future.

**All images were from the Schrödinger website and investor presentation and the information in this deep dive is published in good faith and for general info purposes only. All comments should not be taken as investment advice or consultation just personal opinion. I am not a medical expert or financial advisor, so I encourage investors to get personal advice from your professional advisor. I do have a small position in Schrödinger (ticker: SDGR) and plan on making it one of my core portfolio holdings in the future.